The number of traders net-long is 8.33% higher than yesterday and 2.29% lower from last week, while the number of traders net-short is 1.13% lower than yesterday and 30.37% lower from last week. The IG Client Sentiment report shows 40.57% of traders are currently net-long USD/JPY, with the ratio of traders short to long standing at 1.46 to 1. Until then, the monthly opening range is in focus for USD/JPY as it attempts to defend the November low (112.53), but a larger pullback in the exchange rate may continue to alleviate the tilt in retail sentiment like the behavior seen earlier this year.

#Yen to uad update

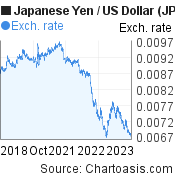

Nevertheless, the NFP report may generate a bullish reaction in USD/JPY as the update is expected to show the US economy adding 550K jobs in November while the Unemployment Rate is seen narrowing to 4.5% from 4.6% during the same period.Įvidence of a stronger labor market may put pressure on the Federal Reserve to adjust its exit strategy as Chairman Jerome Powell pledges to “ use our tools to make sure that higher inflation does not become entrenched ,” and it remains to be seen if the central bank will forecast a steeper path for the Fed funds rate as officials are slated to update the Summary of Economic Projections (SEP) at their next interest rate decision on December 15. USD/JPY Rate Attempts to Defend November Low Ahead of US NFP ReportĪ near-term correction appears to be unfolding in USD/ JPY after it cleared the March 2017 high (115.50), with the decline from the yearly high (115.52) largely tracking the weakness in longer-dated US Treasury yields as the Omicron variant of COVID-19 clouds the outlook for the global economy.

0 kommentar(er)

0 kommentar(er)